MetroPlus Employee:

Group 11

Non-Union

Newly hired MetroPlus employees are required by The Office of Labor Relations to enroll in MetroPlus Health insurance and remain enrolled in the MetroPlus plan for 365 days.

Exemptions to this requirement include if you:

- Live outside the MetroPlusHealth Gold Plan coverage area (the 5 Boroughs).

- Have health insurance coverage through your spouse or domestic partner that you will be using.

Have severe or life-threatening pre-existing condition and your provider does not accept MetroPlusHealth Gold (an Opt-Out Form is required for review and consideration).

MetroPlus Group 11 Benefits Overview

NON-union Employees.

Managerial titles not represented by a union. Managerial Benefits Fund (MBF) provides Vision, Dental, Basic Life Benefits & more.

MetroPlusHealth Gold Plan Options:

- MetroPlusHealth Gold Basic

- MetroPlusHealth Standard Rx (See Attached Prescription List)*

Includes comprehensive drug prescription coverage. Recommended for employees who take medications not covered under the Basic plan prescription list

MetroPlusHealth Gold offers exceptional value to employees and their families. It offers some of the following benefits, including quality care, a broad provider network, and prescription coverage all at no cost to you.

- $0 co-pays**

- $0 premium

- Fitness reimbursement (up to $1,400 per plan year)

- Transportation reimbursement (up to $60 per plan year)

- $0, 24/7 virtual access to doctors and therapists

- NEW: Up to $300 per year for utilizing wellness apps

- NEW $0 nutritionist care

- NEW: Up to 10 acupuncture visits with $0 copay

Quality, Affordable Health Care for all Employees of the City of New York!

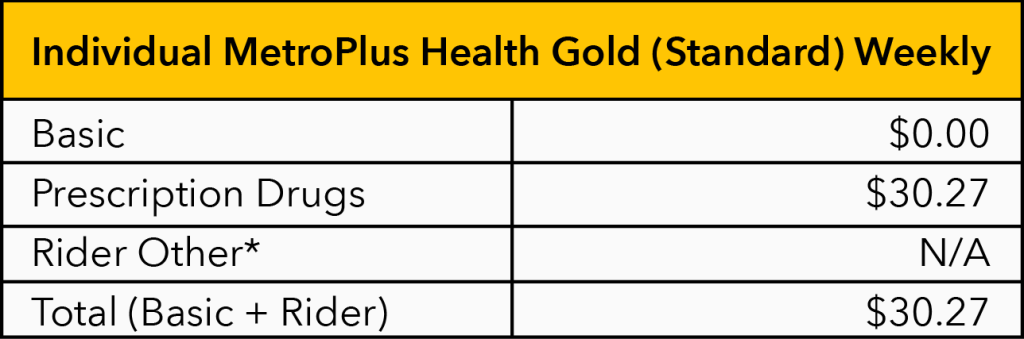

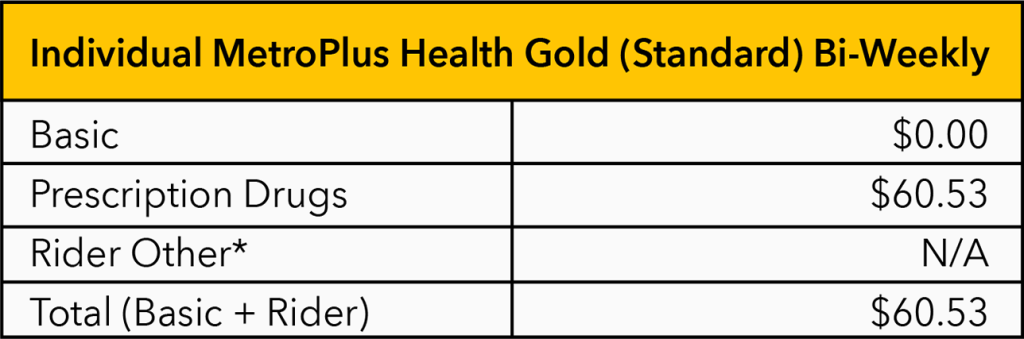

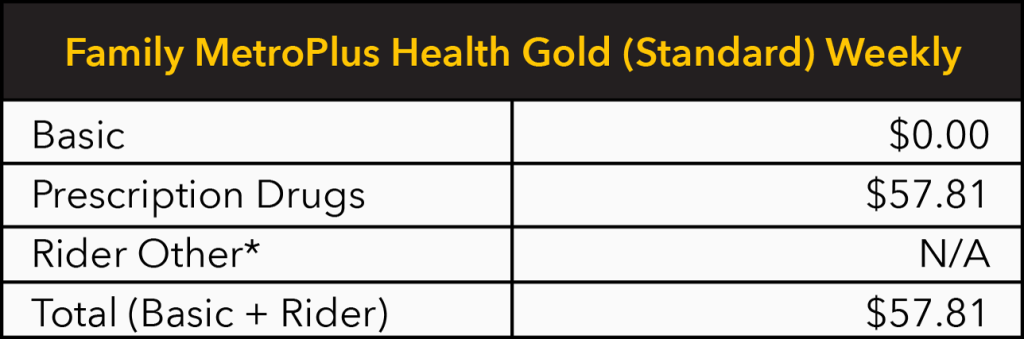

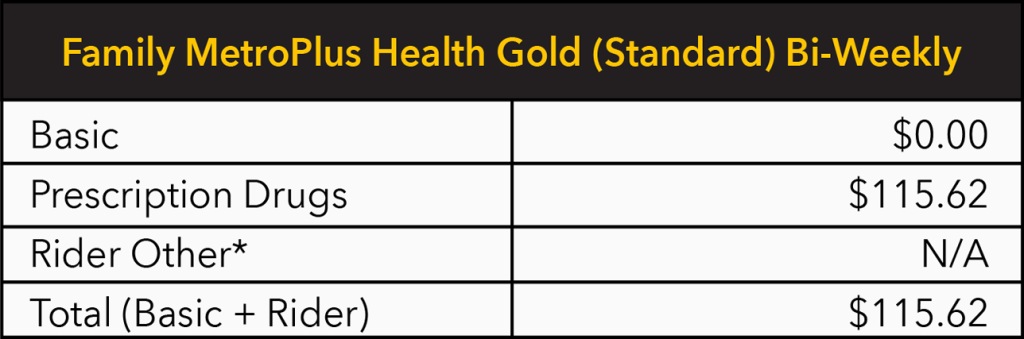

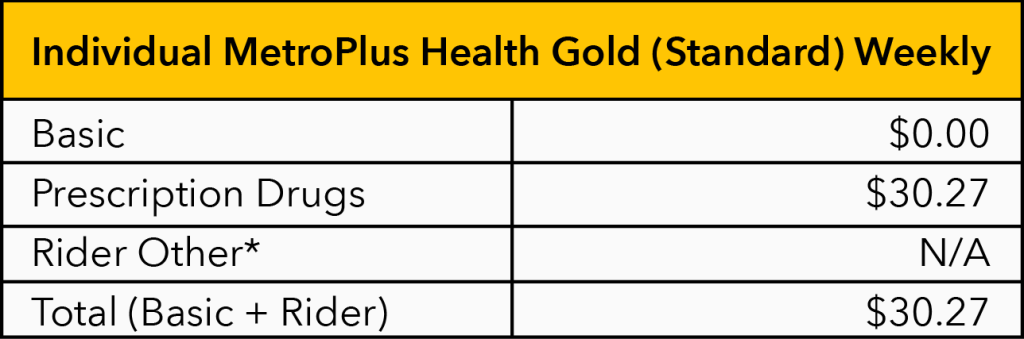

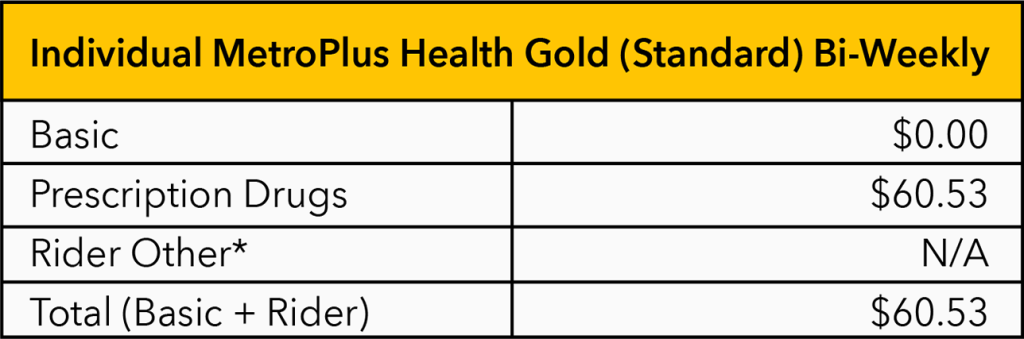

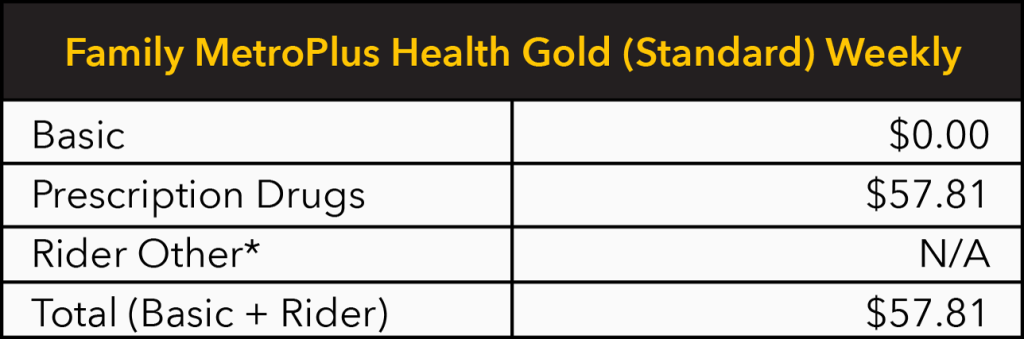

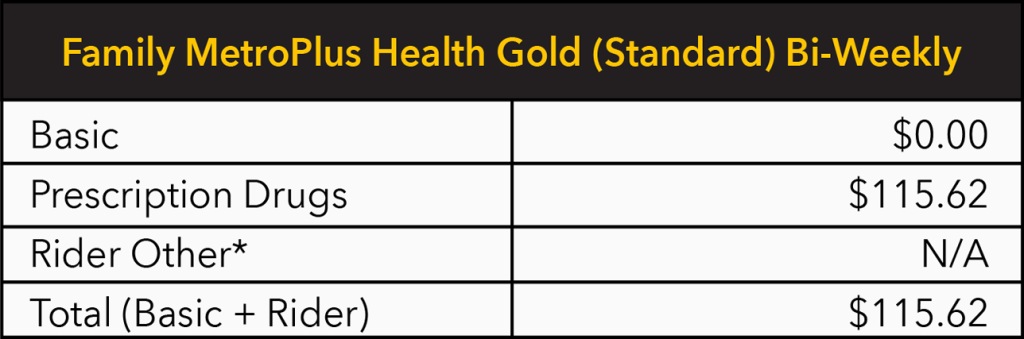

When selecting your medical plan, please note that Group 11 positions do not include prescription coverage. However, it can be added at the time of medical plan enrollment for an additional per-paycheck cost.

Health Benefits Enrollment

List of whom you can cover and the supporting documentation needed

List of medical insurance providers

Per/paycheck deduction for each health plan.

Management Benefit Fund (MBF)

The Management Benefits Fund (MBF) is a welfare program for managerial employees (Group 11) without union representation.

**New Hires will receive an email from HHCBenefits@nychhc.org with the enrollment forms, links and instruction in how to enroll.

** Group 11 employees who need to update due a title change, adding/remove a dependent please email: HHCBenefits@nychhc.org

When choosing your medical plan, please note that Group 11 position do not include prescription coverage and can be added when electing your medical coverage for a per paycheck cost.

Click below to learn more about Management Benefits, view the MetroPlus Group 11 Benefits Overview, or access the MBF Enrollment form

MBF Offers the following Benefits

Flexible Spending Account (FSA)

Flexible Spending Account is a pre-tax savings program that allows you to put money aside for medical expenses not covered by insurance. Any money not spent by the end of the year is not recoupable in the next year.

If you want to enroll in the Flexible Spending Account, please select “FSA Enrollment Form.”

Please call 212-306-7760 if you have any questions or need assistance.

MetroPlus Employee:

Group 12

Unionized

Newly hired MetroPlus employees are required by The Office of Labor Relations to enroll in MetroPlus Health insurance and remain enrolled in the MetroPlus plan for 365 days.

Exemptions to this requirement include if you:

- Live outside the MetroPlusHealth Gold Plan coverage area (the 5 Boroughs).

- Have health insurance coverage through your spouse or domestic partner that you will be using.

Have severe or life-threatening pre-existing condition and your provider does not accept MetroPlusHealth Gold (an Opt-Out Form is required for review and consideration).

MetroPlus Group 12 Benefits Overview

Union Employees.

Employee Titles represented by a union. Most designated Unions provide Vision, Prescription & more.

Group 12 employees are eligible for a comprehensive benefits package that includes medical, dental, vision, and prescription coverage. For details regarding vision, dental, and prescription benefits, please contact your union directly.

If your union does not provide prescription coverage, you have the option to add a prescription rider for an additional cost per-paycheck.

MetroPlusHealth Gold Plan Options:

- MetroPlusHealth Gold Basic

- MetroPlusHealth Standard Rx (See Attached Prescription List)*

Includes comprehensive drug prescription coverage. Recommended for employees who take medications not covered under the Basic plan prescription list

MetroPlusHealth Gold offers exceptional value to employees and their families. It offers some of the following benefits, including quality care, a broad provider network, and prescription coverage all at no cost to you.

- $0 co-pays**

- $0 premium

- Fitness reimbursement (up to $1,400 per plan year)

- Transportation reimbursement (up to $60 per plan year)

- $0, 24/7 virtual access to doctors and therapists

- NEW: Up to $300 per year for utilizing wellness apps

- NEW $0 nutritionist care

- NEW: Up to 10 acupuncture visits with $0 copay

Quality, Affordable Health Care for all Employees of the City of New York!

When selecting your medical plan, please note that Group 11 positions do not include prescription coverage. However, it can be added at the time of medical plan enrollment for an additional per-paycheck cost.

List of whom you can cover and the supporting documentation needed

List of medical insurance providers

Per/paycheck deduction for each health plan.

Vision | Dental | Prescription